Using Apple Pay is easy! Detailed instructions for use. How to set up Apple Pay: instructions. What is Apple Pay and how to use it Add a card to iPhone

There has been a rumor in the media that Apple Pay Cash will soon appear in Russia. It is expected that it will become available to our users after the release of iOS 12.1, but nothing is known about any specific dates yet. In addition, some iOS 12 shows a localized Apple Pay Cash interface, which inspires even more hope that the feature will appear soon:

There is nothing innovative in Apple Pay Cash, but this feature is very cool, and it will be nice if it does appear in Russia. We tell you what it is and how it works in the USA.

How it works?

The principle of operation of Apple Pay Cash is very similar to a virtual bank card. You make yourself a card that you can use to pay and accept payments from other users. The only difference in the Cupertino version is that you can send money on request via iMessage to friends.

How to use the card?

The card is activated in the Wallet application. You need to click on its image, go through all the necessary instructions in the design and you’re done.

You can transfer money via iMessage. In Messenger, click on the Apple Pay icon, enter the required amount and send a message with the request to a friend. If he agrees, he will click on the black picture with the image of the amount, and in a few seconds you will receive the money.

The same card can be used to pay in regular stores using Apple Pay.

What about the commission and withdrawal?

In the US, there is no fee for transferring or topping up a friend’s debit card, but if the card is a credit card, the fee is 3%. With Apple Pay Cash, you can only withdraw money to a linked card in Apple Pay. There is also no commission for such an operation.

Another important point: for transfers of more than $500, the device asks you to confirm the transaction with your Social Security number and date of birth. Therefore, if an American’s phone was stolen and the password was somehow hacked, then it will not be possible to transfer a large amount from the card.

How Apple Pay Cash will work in Russia is unknown. It depends on the bank and agreements with Apple. In the US, Apple Pay Cash is handled by Green Dot Bank, and it was he who set the conditions with the commission. It is unknown with whom Apple is negotiating in Russia, but let’s hope that it will do without a horse commission.

Let's look at the features and security of Apple's contactless service, which launched today in Russia.

First, be sure to read in Russia. Here we will look at general issues of operation and safety so that you know what you are using and how it works.

What is Apple Pay?

The Apple Pay service was created to simplify the buying/selling process. Instead of using a plastic card or cash, any purchase can be made using an Apple gadget.

Compatible devices for offline payment:

- iPhone 6 and 6 Plus

- iPhone 6S and 6S Plus

- iPhone 7 / 7 Plus

- Apple Watch

- iPhone SE

You can pay via iPad and Mac only online.

Payment occurs when the user brings their iPhone or Apple Watch to the contactless terminal. After a few seconds, a message appears on the screen about the possibility of payment and a proposal to confirm the transaction using a fingerprint scanner or password

Apple Pay has been around for over a year and a half. As of 2016, it operates in 9 countries: England, Australia, Hong Kong, Canada, China, Singapore, USA, Switzerland and France. Today the system.

How it works?

The basis: The mechanism of the system is based on NFC technology for close data transmission (at a distance of up to 20 cm) in conjunction with the Secure Element chip, which stores bank card data in encrypted form. Secure Element represents the industry standard in financial transactions. This chip runs a custom Java application.

Secure Element: This is an area of dedicated memory that is separate from system memory. This area stores the user's bank card data. No program has access to it, no data is transferred anywhere, and even Apple cannot influence this strategy. So no one will know about your purchases and cash flows.

Secure Enclave: it is the component that manages the authentication process and initiates payment transactions. At the same time, it stores the fingerprint for Touch ID.

Apple Pay Servers: This is the backend that manages the status of credit and debit cards in the Wallet app, along with the device number stored in the Secure Element. Apple Pay Servers are also responsible for transcoding payment information within apps.

History and partners

Contactless payment technology has been used for quite a long time – since the middle of the first decade of the 21st century. But throughout its existence, it has not gained popularity. Even the concept of Apple Pay is not new. Google has already tried to take a place in this niche with its inconvenient Google Wallet service.

Apple Pay is compatible with many existing contactless readers: Visa PayWave, MasterCard PayPass, American Express and ExpressDay.

In addition to the fact that Apple’s service is supported by hundreds of banks, you can pay using your smartphone at any terminals that support contactless payment methods.

Where can I pay with Apple Pay?

Payment is made without entering a bank card number and other bank information. You just need to put your finger on Touch ID.

During the purchase process, Apple Pay may share additional information stored on the buyer's phone, such as shipping address and phone number.

What is Apple’s “profit” from the Apple Pay service? It's simple: the corporation receives 0.15% from each transaction - this is a fee for servicing the payment service and creating application tools. This money is paid to her by banks: Citi, plus existing payment systems, MasterCard and Visa.

What about security?

Apple Pay has a multi-level security system: a unique device identifier, dynamically generated security codes for each payment transaction, biometric information - a fingerprint.

Taken together, these tools provide more reliable security than a magnetic stripe or even a chip in a bank card.

During connection creation, devices exchange one-time tokens, which are deleted when the connection ends. The token is designed to replace the card number so that no one recognizes the latter. The token represents a randomly generated number, so the bank card number hidden behind it cannot be decrypted.

All this comes together and replaces the CVV of a bank card for a payment transaction. After establishing a connection and exchanging tokens for data transfer, they are encrypted. These encrypted messages reflect their ownership of the specific device that created the token used.

Even if the token is intercepted, it will not provide the attacker with valuable information, since after the connection is broken, the token is deleted.

Although the message contains information about the buyer, the seller, the amount of money involved in the transaction and the bank that provided the card, all data is securely encrypted. Apple does not disclose information about the encryption algorithm, which causes an uproar among some information security specialists.

Apple motivates its partners to switch to more modern payment terminals according to the EMV specification, that is, replacing the magnetic stripe of plastic cards with a Secure Element chip, which is almost impossible to hack using data interception.

Hacking theory

There was a fly in the ointment in this barrel of honey. No matter how hard the developers try, there are problem areas in the Apple Pay service. And this largely does not depend on Apple. Many other entities are involved in the movement of funds, including banks with their huge security gaps.

The fingerprint scanner does not always work correctly. While it provides a modern and seemingly secure means of identification, it also presents a huge security hole. If Touch ID fails, you can use the PIN code. This negates all advanced security.

The PIN code can be spied on, confused, the wrong keys pressed, in short, the human factor is at work. When paying with an Apple Watch, a fingerprint is not required, in which case the issue of security becomes more acute.

In this regard, additional verification tools have appeared: a secret code, a one-time password, calling customer support or providing information about previous purchases.

Some banks in other countries require the user to log in to mobile internet banking. These steps reduce the usability of Apple Pay by introducing additional layers of verification.

At the moment, the simplest payment format works in Russia without additional authorizations in the process.

Meanwhile, Apple Pay is still not hacked.

Apple Pay competitors

In 2011, Google Wallet entered the contactless payment market, but it did not become popular largely due to the fact that there was a strong competitor in the NFC payment market - Softcard, supported by the largest US mobile operators. But now he's deflated. And Google bought it for $100 million.

Using developments in the field of contactless payments Softcard, Google launched the Android Pay payment service, which works on principles similar to Apple Pay.

The market also operates the Samsung Pay service. To implement this, Samsung bought LoopPay for $250 million. The latter offers additional devices for contactless payments. The main advantage of LoopPay, and now Samsung Pay, is compatibility with older devices.

There is also PayPal with a service that makes payments through QR codes. It was developed by Paydiant, which was acquired by PayPal. To scan QR codes, use a smartphone with the iOS or Android operating system and installed the CurrentC program, which uses Paydiant technology.

The downside is obvious: there is a time delay - you need to carefully hold the smartphone over the QR code to take a picture.

The future of Apple Pay

Leave your wallet at home. Now you can use your phone instead of a bank card. This became possible thanks to the Apple Pay payment system.

Since 2014, Apple Pay has been conquering country after country. Apple Pay is currently available in Canada, the United States, the United Kingdom, France, Spain, Russia, China, Japan, Hong Kong, Switzerland, New Zealand, Singapore, and Australia.

How Apple Pay works

Apple Pay works through a special NFC chip, which is installed on all new iPhone and iPad models and the Apple Watch series.

NFC (Near Field Communication) is a short-range wireless technology that allows two devices (such as a telephone and a terminal in a store) to exchange payment information quickly and conveniently in close proximity.

You simply bring your iPhone to the terminal at the checkout of a store or restaurant while holding your finger on the Touch ID button.

Which devices support Apple Pay?

You can pay for purchases in stores using:

- iPhone 6/6S, 6/6S Plus

- iPhone SE

- iPhone 7, 7 Plus

- Apple Watch (1st generation)

- Apple Watch Series 1 and 2

Pay for purchases in applications and on the Internet:

- iPhone 6/6S, 6/6S Plus

- iPhone SE

- iPhone 7, 7 Plus

- Apple Watch (1st generation)

- Apple Watch Series 1 and 2

- iPad Pro (9.7 and 12.9 inches)

- iPad Air 2

- iPad mini 3 and 4

In addition, you can now pay for purchases using a MacBook Pro with a Touch ID sensor, but this can only be done in the Safari browser. And paired with an Apple watch or iPhone, you can pay for an online purchase from a Mac computer, but only if your computer model is older than 2012.

Which banks work with Apple Pay in Russia

- Alfa Bank

- Raiffeisenbahn

- Tinkoff Bank

- MTS Bank

- Rocketbank

Mastercard cards only:

- Saint Petersburg

- Sberbank

- VTB 24

- Binbank

- Russian standard

- Opening

- Dot

- Yandex money

The list of banks is constantly expanding and updating.

Apple pay Sberbank visa when will it work? They promised back in December. But negotiations are ongoing and the dates are constantly being postponed. We wait!

How to use Apple pay:

How to connect Apple Pay and how to set up Apple Pay

There is no need to install or configure anything additional. If, of course, your device supports Apple Pay. Just go to the Wallet app and add payment cards to it. Most of us are concerned about the question of how to connect apple pay to Sberbank, because Sberbank cards are the most popular in Russia. You don't have to go to the bank, just add your Sberbank card to the application.

How to add a card

Add a map to iPhone:

- Open the Wallet app on your smartphone

- After confirming the bank, click “Next”

Ready!

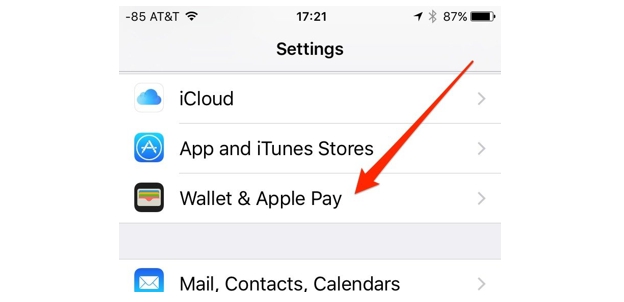

Add a map to iPad:

- Open "Settings"

- Select the “Wallet and Apple Pay” section

- Click “Add payment card”

- If you have already paid with this card in iTunes, you just need to confirm the card information using the security code

- If there is no card information in iTunes, you can enter them manually or film them.

- Click "Next". The bank will verify the card details and may request additional information for confirmation.

Ready!

Add a map to Apple Watch:

- Open the Watch app on iPhone

- Click "Wallet and Apple Pay"

- If the card information is already stored on your iPhone, tap Add next to the card

- If you need to add a card that is not yet stored on your iPhone, click “Add a payment card”

- If you've already paid with this card in iTunes, you just need to confirm the card information using the security code.

- If there is no card information in iTunes, you can enter them manually or film it

- Click "Next". The bank will verify the card details and may request additional information for confirmation.

- After confirming the bank, click “Next”

Ready!

Add a map to your Mac:

- Open “System Preferences” in the computer menu

- Select the menu section “Wallet and Apple Pay”

- Click “Add card”

- If you've already paid with this card in iTunes, you'll need to confirm your card information. Just enter the security code.

- If there is no card information in iTunes, you can enter it manually or film it on your phone camera

- Click "Next". The bank will verify the card details and may request additional information for confirmation.

- After confirming the bank, click “Next”

Ready!

Can I use multiple cards?

You can add up to 8 cards to the device.

Where can you pay with Apple Pay?

Apple Pay works anywhere that accepts contactless payments. To understand this, look at the cash register or next to the terminal for a symbol for accepting such payments.

You can also make in-app purchases and through the Safari browser on the web.

How to pay with Apple Pay

In the shop:

When you pay for a purchase in a store, simply bring your phone to the terminal at the checkout and place your finger on Touch ID. You don’t need to open the application or unlock the screen, you don’t even have to look at your phone while paying, you will know that the payment has been successfully completed by the signal and subtle vibration of your iPhone

To make a purchase in a store using your Apple Watch, you need to double-click the button on the side and hold your watch close to the contactless reader. A gentle pulse and signal will confirm the success of the payment.

In the application:

For an in-app transaction, you must select the payment option “Apple Pay” or “Buy with Apple Pay.” After selecting payment, place your finger on the Touch ID sensor. After successful payment, you will see “Done” on the screen.

How to make a return

Returning via Apple Pay is not much different from returning via card.

The cashier may need your account number. You can find this number by selecting the card in the “Wallet and Apple Pay” window and clicking on the “i” sign

To process your return, be sure to select the card on your device that you used to make the purchase. Bring your device close to the payment terminal and confirm your return using Touch ID or enter your password.

The money may not be returned to the card immediately, but within a few days, it depends on the bank’s refund policy.

Is it safe to pay with Apple Pay?

Don't worry about the security of your payments. After all, paying for purchases through Apple Pay is even safer than with a regular card. Apple Pay doesn't use your card number. Instead, the system assigns a unique encrypted number to the card, which is stored on a special chip on your device. This chip can only be accessed during a transaction.

The data on the chip is in no way connected with the other software of your gadget, even if someone hacks your operating system, there is no way to extract financial information from it. Thus, during payment, your card details are hidden both from the seller and from surrounding people.

Additional security is provided by using a fingerprint to confirm payment.

What to do if the card is lost or stolen

If your card is lost or stolen, you should immediately notify the bank and block the card. After this, your card will be deactivated on all devices. When you receive a new card, add it to the application again.

What to do if your device is lost or stolen

If your phone gets lost or stolen, you can block Apple Pay remotely. Go to Find My iPhone on your other device or browser and turn on Lost Mode. Apple Pay will be stopped, your phone will be locked, and your data will remain safe.

As you can see, using Apple Pay is easy. The main thing when paying using your phone is not to forget about it and not to spend more than you planned.

In September 2017, the Apple Pay payment tool turned 3 years old. During this time, he managed to achieve incredible popularity in America, Europe and, above all, Asia. The statistics collected by the Apple company are amazing: if you believe them, every second mobile phone owner in India, Thailand and Indonesia prefers Apple Pay. The geography of Apple Pay is regularly expanding: at the end of 2017, you can pay for purchases using this tool in such exotic places as the islands of Jersey and Guernsey, and even in the Vatican.

Jennifer Bailey, vice president of Apple, says that 98% of Apple Pay users are satisfied with the mobile payment system - and all thanks to its simplicity and security. A user who still prefers to roll a card with a magnetic stripe across a pin pad should try a new method - there is a high probability that he will no longer want to go back to the old one.

The operating principle of Apple Pay is based on technology - wireless data transmission over short distances (maximum 20 cm). The system digitizes the user’s bank card and encrypts the information using another important component – the Secure Element chip. The information contained in the Secure Element's memory is not transferred anywhere and Apple cannot access it either.

Apple Pay includes other elements:

- Secure Enclave– Responsible for authentication, payment transactions and storage of fingerprint data.

- Apple Pay Servers– the server part of the payment system, which is responsible for the status of cards entered into Wallet.

When the owner of the smartphone brings it to the pin pad, the 2 devices are paired. They begin to exchange so-called tokens– randomly generated sequences of numbers. If, knowing the token, you select the key and decrypt it correctly, you will receive a bank card number. However, in reality this task is practically impossible. It is worth noting that intercepting a token is also not an easy task; the information is deleted immediately after the pairing is broken (that is, the transaction is completed).

The note. Apple carefully hides information about the encryption algorithm - which greatly angers the intelligence services of different countries. However, the company's stubbornness is justified - apparently, Apple understands that if it gives the key to anyone, it will lose the respect of users.

What devices support Apple Pay?

Owners of the following devices can use Apple Pay:

- iPhone 6th, 7th and 8th generations, as well as X and SE models.

- iPad 4, mini 3, Air 2 and Pro tablets.

- iWatch.

- Macs released after 2012.

Apple Pay can also be set up on 5th generation iPhones – but in this case it’s not possible without it.

How to connect Apple Pay?

First of all, you need to link your bank card to the service. If the card is issued by Sberbank, you should proceed as follows:

- Download, install and open the Sberbank Online application.

- Select the appropriate one from the list of cards and click the " Apple Pay».

- A window will appear on the screen prompting you to add the card to Apple Wallet. Click on the appropriate button - this is what you need.

- On the next screen, select the device you'd like to connect Apple Pay to - iPhone or Watch. Then at the stage " Adding a map» click the « button Further».

- Accept " Terms of user agreement».

- When the message “ Map added!", click on " Ready" The card is now linked to Apple Pay.

In the same way, you can link another card to the payment system. If there are several cards, they should be managed in the proprietary Wallet application.

You can link a card without using the bank application - directly in Wallet. Open the program. If there is an Apple Pay icon in the upper left corner, then the system is already activated. If not, go to the settings section " Wallet & Apple Pay" and turn it on.

Then in the Wallet app, tap on " + » in the upper right corner, enter the card details manually or take a photo of it. After this, the payment system must approve and remember the card.

If such a message appears on the screen, it means that either you are trying to link a card from a bank with which Apple Pay does not yet cooperate, or the card balance is less than 1 ruble. As of 2017, the list of banks supporting the Apple payment system is already quite extensive - it includes:

- Sberbank.

- VTB 24.

- Alfa Bank.

- Rosselkhozbank.

- Promsvyazbank.

- Raiffeisenbank.

- MTS-Bank.

- Gazprombank.

- Tinkoff.

Also, all Megafon, Beeline, Corn, and Yandex.Money cards are linked to Apple Pay.

How to use Apple Pay?

To pay for a purchase using Apple Pay, just bring the gadget to the pin pad and place your finger on Touch ID, thus confirming the debiting of funds.

You need to pay with the Apple Watch a little differently: you need to double-click the button located on the right side of the watch and turn the device with the screen towards the pin pad. A characteristic sound will be heard - this means that the payment was successful.

If the purchase amount exceeds 1,000 rubles, you may need to enter a PIN code or sign on the display.

The note. During payment, the Internet must be activated on the gadget - mobile or Wi-Fi - for data exchange. If your iPhone is in airplane mode, you won't be able to pay for your purchase.

Many users are interested in this question: do they have to pay a fee for using Apple Pay? It’s true, there is a commission, but it is not the owners of the devices who are required to transfer the percentage, but banks and payment systems MasterCard and Visa - 0.15% from each transaction. The users themselves do not overpay anything.

Conclusion

The Apple company continues to improve Apple Pay. With its release in 2017, iPhone owners now have the ability to make direct money transfers. The service that allows you to do this is called Apple Pay Cash; unfortunately, it is only available in the USA for now. However, there is no doubt that Apple Pay Cash will reach Russia sooner or later.

Apple is also actively expanding the geography of its payment system. According to rumors, Apple Pay will soon appear in other countries of the former CIS. First up is Belarus.

Information updated: 12/27/2019

Key Russian banks have started working with Apple Pay. Important aspects of the long-awaited event.

What's the matter?

In November, a joyful event occurred for Russian iPhone and Apple Watch owners.

The safest, fastest and most convenient service for paying for services and goods offline in the global global network - Apple Pay - is available to clients of large Russian banks.

What is Apple Pay for?

Pay for purchases or services in regular stores and on the Internet using your own iPhone or Apple Watch. There is no need to connect the device or insert it anywhere, nor do you need to hand it over to the cashier.

You can authorize a purchase using your fingerprint, that is, the same action that unlocks your smartphone, or by pressing the watch button twice. We bring the device to the terminal into which we are accustomed to inserting a bank card, bam-bang - and the goods are fully paid for. Instantly and completely safe. Forget about cash, and you don’t even have to take the card out of your wallet.

List of devices that support Apple Pay

The Apple Pay service was presented in the United States a couple of years ago, so iPhone and Apple Watch manufactured in 2014 support it along with more recent models:

- iPhone SE

- iPhone 7

- iPhone 7 Plus

- iPhone 6

- iPhone 6 Plus

- iPhone 6s

- iPhone 6s Plus

- all Apple Watch models

Owners of iPhone 5 and iPhone 5s can use Apple Pay only through the Apple Watch..

How Apple Pay works

The latest iPhone and Apple Watch models are designed in such a way that a special microchip is installed inside the gadgets, allowing data to be transferred over a distance of several tens of millimeters. By bringing the device to the terminal and authorizing the purchase, you launch internal bank mechanisms. There is no point in going into the further process - these are complex technologies. Safe, ultra-secure, but extremely fast. A split second, and the purchase is paid and completed.

So what's the difference with NFC?

For many, this question will immediately come to mind. The answer is, Apple Pay is much more, although very similar. The component of the service responsible for contactless payment is indeed based on NFC technology. That is why it is possible to combine with all possible terminals.

Banks have established and successfully used the technology of issuing cards with NFC chips. Owners of Android devices use third-party applications to pay for goods and services. Contactless payments have been debugged, tested, reliably protected and absolutely safe.

Apple Pay is not only payments via NFC, but also a systematically operating payment system that fully protects user data and money everywhere, especially when making purchases on the Internet. Additional security is created by dynamic codes transmitted instead of personalized data from the card. The codes completely keep all information about the user secret.

It is safe?

Idle fiction about the risks of contactless payments, including double debits, is spread by technology-savvy people. They spread rumors without knowing anything themselves.

Even after losing a smartphone or smart watch, the user’s chances of losing his savings are zero. The person who stole or found the gadget will not be able to do anything with it without your fingerprint. Accordingly, payment data without a fingerprint is not available. For those who like to play it safe, the Find My iPhone program is installed, which remotely disables the payment function on the watch or smartphone.

Apple Pay has been working flawlessly since 2014 in the US and a number of European countries. The best test of the system is the billions of purchases made with its help during this time. Everything is protected, like the gold reserves of the Federal Reserve Bank.

Does my bank work with Apple Pay?

Finding out such information is quite simple. View news on the bank's website, call the hotline or read social networks. As a rule, progressive and reliable banks are the first to introduce high-tech innovations. For example, Tinkoff was one of the first to announce support, immediately after testing the service by Sberbank clients. By the way, we already went to the nearest store - the system works great.

What should I do if I don’t have Apple Pay in my bank and don’t expect it yet?

Most likely, change bank. This is a matter of taste and personal priorities. Almost all people in society are divided into two types:

- Those who evaluate the size of the bank and put this at the forefront

- Those who value benefits and convenience

You can follow our example and take a closer look at progressive credit institutions, such as Tinkoff Bank.

Tinkoff Bank has the best remote service, and managers visiting a place convenient for the client to meet is an exclusive service. The mobile application, with many useful options such as automatic notifications, payment of fines and much more, as well as favorable conditions for cards and excellent offers for savings and purchases, puts Tinkoff Bank among the desirable banks working with Apple Pay.

Tinkoff Bank offers 7% per annum on the balance, adding to this monthly capitalization, cashback up to 5%, with the ability to choose a return category, repayment without commission, free card issue, without the tedious collection of certificates and a visit to the bank.

Apple Pay review

Apple Pay interface:

Purchase process using Apple Pay - bring your device to the terminal to pay:

Purchase process using Apple Pay - payment using Touch ID (apply your finger)

Infographics

So, Apple Pay allows you to pay for purchases using a bank card connected to the NFC module in your iPhone or Apple Watch. To use it, you need:

- Determine if your card and device support this payment method

- Install the Apple Pay app and add your card to it

- During the payment process, bring your smartphone to the POS terminal and, if required, confirm the transaction using Touch ID or Face ID

- If there are several cards, select the one from which you want to debit money

Apple Pay provides a high level of security for all transactions and does not leak card details to third parties.

Did you find the answers to all your questions in this article?

Founder of the #AllLoansOnline project. He worked in the banking industry for a long time, so he knows well how it works inside and out. Understands all banking products and their operating rules. In his spare time, he studies new banking products and technologies.

maxzaharov@site

(9 ratings, average: 5.0 out of 5)